As we brace ourselves for undeniable regulatory changes within the healthcare industry, often we neglect conversation about the shortcomings of our current system to ensure we don’t repeat the same mistakes. Although many would agree that the intentions of the ACA (“Expand access to health insurance, protect patients against arbitrary actions by insurance companies, and reduce costs”) were created with social good in mind, experts are strident that the mechanisms used to create this social good have failed to correct the economic epidemic that currently infects our healthcare system.

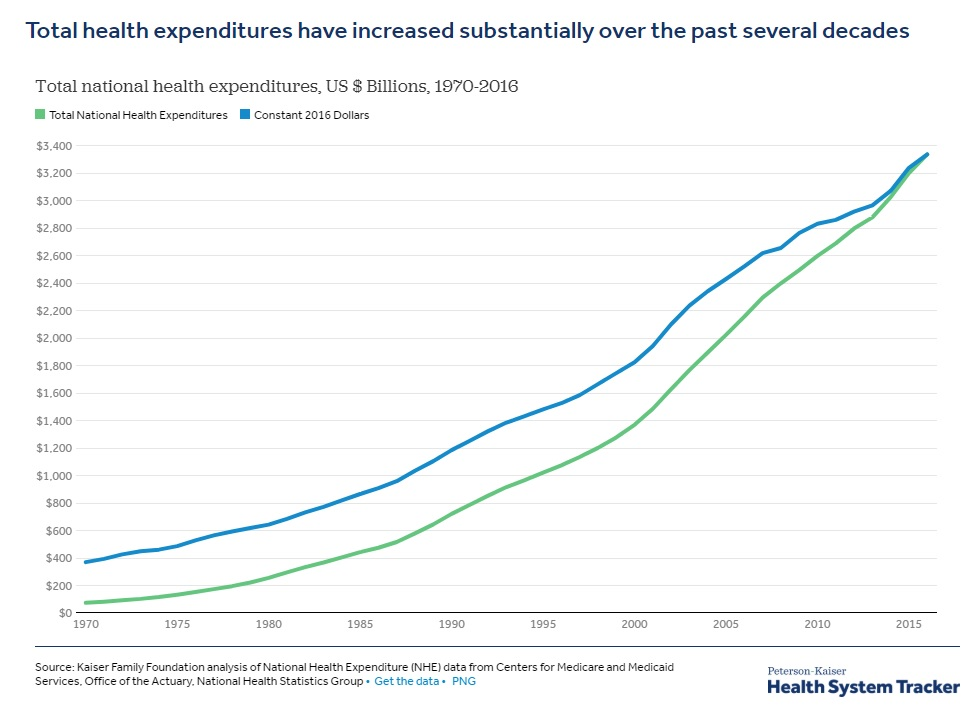

If you think “economic epidemic” is a hyperbolic term to use in this context, think again. As referenced in my previous blog post about the continuing battle to repeal the ACA, the U.S. domestic healthcare system costs around $3.3 trillion to the American economy each year. What’s less known is that this figure is projected to continue rising as it has almost every year since the 1960s.

Some are projecting the U.S. to hit bankruptcy as early as the year 2035 if this trend continues to grow as exponentially as it has the past few decades. With baby boomers entering their elder years and both millennials and generation X set to surpass the population totals of the boomers by 2028 (Millennials in ’19 and Gen X in ’28), we can expect the requirements of our nation’s healthcare program to rise as well. Now is the time for change. As I alluded to earlier in this piece, we need to be cognizant of our past mistakes to ensure they aren’t repeated down the road with financially dire consequences.

The MLR Rule: Medical-Loss Ratio

The MLR rule is a lesser known mandate to the public that was included in ACA implementation. Some will argue that it had positive intentions in how our insurers spend premium dollars, which isn’t incorrect in theory, but it has a troubling method in which it determines how the rule is executed.

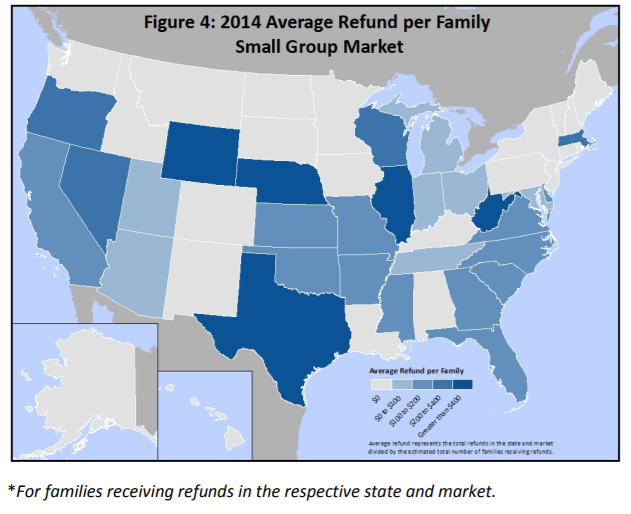

In short, the MLR rule for small employers dictates that insurers must spend 80% of every premium dollar (it’s 85% for large employers) toward actual medical expenses, claims, and quality improvement. This percentage does not include items such as advertising, administrative costs, and profit to which the remaining 20-15% of premiums are spent. There are provisions in place that when insurers fail to satisfy at least an 80% loss ratio they must issue rebates back to consumers. These rebates totaled $469 million dollars in 2014, with 29.86% of those rebates attributed to the small group (under 500 employees) market.

Image via the Centers for Medicare & Medicaid Services

Many insurers will build in features such as risk assessments, screenings, and coaching hotlines to ensure their “medical expenses” reach the MLR threshold regardless of whether their consumers are likely to use those enhancements or not.

The failings of this rule are relatively simple to point out in economic terms: if an insurer’s profits are dictated by a fixed percentage of product costs—in this case we’re speaking of “cost” as medical premiums—the business/insurer has every incentive to see the overall cost of its product rise, thus increasing profit margins.

As we diagnose some of the issues included in the ACA and what to avoid in future reform policies, I think this percentage based MLR rule must be exiled. Our economy can’t afford to maintain the rate of rising healthcare costs with large insurers incentivized to maintain a similar mantra. I think we can achieve a healthy balance between the two, but improved consumer-centric policies must serve as the catalyst.

Current Solutions for Businesses: Self-Funding

Although the tone of this article may seem slightly cynical, I promise it’s not meant to be. However, I do think it’s necessary to be transparent of the flaws within our current system. There are alternative options for businesses looking to get ahead of the upcoming reform trend before it hits home in the coming years.

One solution is self-funding, which was included in the ACA as an alternative funding source outside of fully funded group insurance and is immune to the MLR rule. The immunity to MLR and other provisions within the ACA allow self-funded groups to control healthcare spending by accessing live claims data, become risk rated, and earn back unused premium at the end of their policy year. Since most self-funded groups aren’t managed by a large carrier, but rather the business itself or a reinsurer with similar interests as the group, premium costs are more easily maintained to fit an appropriate fiscal trend without the controversial incentives found nestled within the ACA.

With GMS specializing in level-funding, a form of self-funding, we feel that the transparency of our healthcare consultants and creative product solutions align us with the goals of many employers. Continue to follow GMS benefit related blog posts to stay on top of current healthcare advances and reach out to your local office to learn more about the healthcare solutions we can create together.