A recent article written by the Wall Street Journal outlines some startling financial data in regard to our domestic health insurers and their cryptic billing process established by CMS (Center for Medicare/Medicaid Services). Although GMS typically focuses on the private insurance markets—as they are the most relevant for businesses—examining the continued failures of CMS may provide some insight as to why our domestic healthcare system operates so poorly and why prices for both public and private health insurance markets are sky-rocketing.

A Look into the Market’s Rising Prices

Medicare is a socially-funded program meant to provide health benefits for tax-paying citizens age 65 and older and permanently-disabled individuals of all ages. Medicare, a majority of the CMS which also splits some funding with state and federal Medicaid programs, is typically divided into four parts, coined Medicare parts:

- A (Hospital insurance)

- B (Supplementary Medical insurance)

- C (Medicare Advantage)

- D (Medicare prescription drug benefit(s))

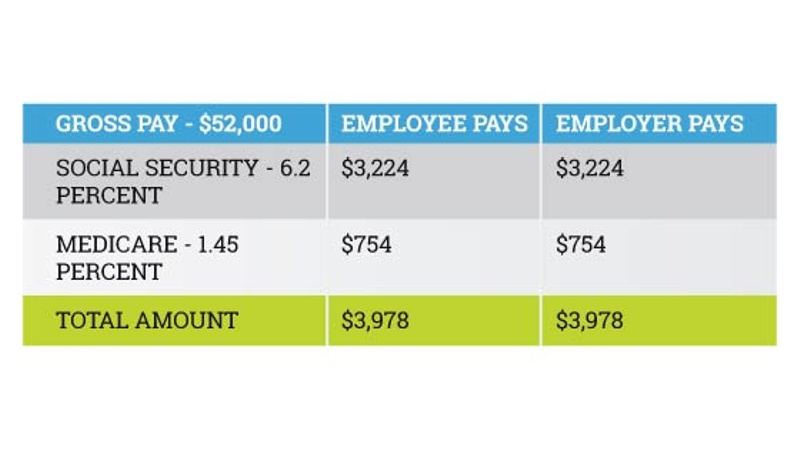

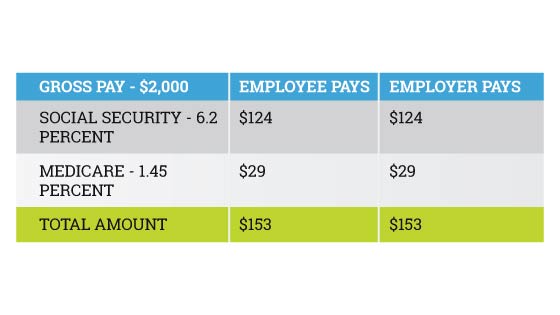

Medicare is funded primarily by tax-payers and Medicare subscribers who are required to pay a monthly premium to utilize the benefits provided through CMS policies.

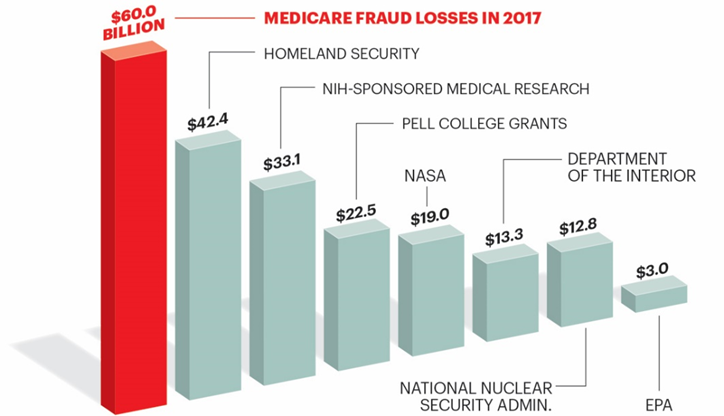

What most citizens don’t know is that CMS is the largest buyer of healthcare policies in the world and files enough fraud, waste, and abuse statistics to land itself within the Fortune’s 500 top 50 based solely on the amount of money lost each year. That’s right, the fraud waste and abuse of Medicare in 2017 was enough to top revenue for entire organizations like Best Buy, Disney, and Fed-Ex. The figure also dwarfs the full budgets for programs like Homeland Security, the EPA, and NASA by tens of billions of dollars, if not more.

As astonishing as those statement may be, these trends have continued almost every quarter, year, and decade since 1965:

Contributing to this $60 billion eyesore is an antiquated billing system that largely remains confidential. What the WSJ highlighted (and what we’ll continue to discuss for the remainder of this article) are the overpayments made to Medicare Part-D insurers for inaccurate estimations of cost for upcoming fiscal years (FY). As detailed above, Part-D handles the Rx benefits for Medicare subscribers and is interestingly administered 100 percent by private insurers.

These “overpayments” surpassed the $9 billion mark from 2006-2015 and were paid out to private insurers on top of existing revenue for administering these Part-D plans. The question as to how $9 billion seemingly slipped through taxpayers’ hands and into the revenue stream of top-insurers is what’s intriguing… or maybe infuriating is the right word to use here.

The Bidding Process for Private Insurers

In order to address that question, we’ll need to take a brief look into the bidding process for these private insurers and how re-payments by CMS are made on an annual basis.

Every summer Part-D insurers send detailed cost-projections for what it would take to fund all Medicare Part-D subscribers’ prescription costs for the following year (about 40 million people). These projections are split into two main categories: Direct Subsidies and Reinsurance Subsidies.

Direct Subsidies contain projections for the majority of services through Part-D. When insurers submit these bids and real costs fall below what was originally projected, CMS allows insurers keep a portion of the difference. Keep in mind that these “projections or bids” are what Medicare bills to taxpayers to ensure proper coverage. In this case, insurers are seemingly incentivized to inflate their bids (by an obvious but overlooked billing loophole) knowing they’ll get to keep some of what isn’t used by the Medicare Part-D population while taxpayers get to bear the financial brunt of these egregious errors.

Reinsurance Subsidies are siloed for Medicare subscribers that have extremely high-costing medications. These high-costing medications, sometimes referred to as “specialty” meds, can often times be upwards of $5,000 for a 30-day supply. Humira, a popular drug that’s used to treat Rheumatoid Arthritis among other chronic illnesses and is often advertised on television, will run you about $6,409 for a 28-day supply without applicable medical or prescription insurance. For these subsidies, insurers must pay back any overages in cost projections should they fall above what was actually spent. However, if insurers’ projections fall below what was actually spent, Medicare will fund the remaining amount.

Imagine you’re the controlling party for one of these large private insurers. If you could legally receive billions of dollars simply by “over-projecting” one of your bids and legally save billions of dollars by undercutting a different bid with the sum of those earnings or savings being pushed off to the subscribers you’re insuring and American tax-payers, what would you chose?

The Grave Reality of the U.S. Healthcare System

Given the above details, the first question that comes to mind might sound something like this: “So Medicare Part-D allows 100 percent administration of a federally subsidized program by private insurance companies, but also allows said companies to submit their own budget forecasts and allows them to keep some of that allocated money if they’re wrong in creating those budgets?” With an 11 percent error rate in 2016 Medicare payments, it’s not hard to see how this staggering $9 billion figure is only a fraction of what the programs wastes annually. Applying these malpractices to a $3.5 trillion-dollar industry (the United States healthcare system, which is showing steady annual spending growth and will likely eat over 25 percent of the GDP within the next decade) and the grave reality of what’s at stake is easily recognizable.

I would highly encourage anyone interested to read more about the WSJ’s findings, but will conclude with the following:

As the economic epidemic of our healthcare system continues to worsen, it’s articles like this from the WSJ that bring to light how much taxpayer money is truly wasted through an irresponsibly administered system like CMS. The issues found here can be replicated time and time again throughout various programs in our healthcare system and are a big piece of why healthcare costs, specifically insurance premiums, continue to climb.

Although it’s not always enjoyable to put these concerning statistics and unsavory business practices in frame for our readers, the transparency that GMS owes to our clientele will always reign. If you’re interested in working with realistic brokers to create modern solutions for your group’s health plan, contact GMS to speak with a dedicated healthcare professional.