Starting a new business is an exciting endeavor, but it also requires a lot of preparation. Part of this process includes taking measures to make sure the business is set up properly so that you can legally conduct business. Here’s what you need to do to make sure that your new business is ready for success according to federal, state, and local regulations.

Register Your Business

Registration is the first step toward making your business a distinct legal entity. The rules on what you need to do to register your business vary depending on two factors: your location and business structure.

State registration

Depending on where you conduct business, you may only need to register your business name with your state and local government. This can be as simple as providing an entity name to your state and county clerk’s office, along with a Doing Business As (DBA) name if you conduct business under a different term than your personal or entity names. However, a registered agent that will receive official legal documents or other papers is required for any new LLC, corporation, partnership, or nonprofit corporation. This agent must be in the same state as where you register.

When it comes time to register in your state, you’ll need to provide some basic information and pay a fee. The cost of business registration varies, but it’s typically somewhere around a few hundred dollars. The information you provide typically includes your business name and location, registered agent information (if required), and details on ownership, directors, and management structure. Certain states may also require some additional documents based on your business structure. Per the Small Business Association (SBA), these can include:

- For LLCs

- Articles of organization

- LLC operating agreement

- For limited partnerships

- Certificate of limited partnership

- Limited partnership agreement

- For limited liability partnerships

- Certificate of limited liability partnership

- Limited liability partnership agreement

- For corporations

- Articles of incorporation

- Bylaws of resolutions

- Number and value of shares

If you plan to operate in states outside your registered location, you’ll need to file for foreign qualification. This requires filing a Certificate of Authority with the state office in question and paying any related fees. According to Forbes, foreign qualification is required if you can answer “yes” to any of the following questions.

- Do I have a physical presence (e.g., office space or retail store) in the state?

- Did I apply for a business license in the state?

- Do I often conduct face-to-face (not just email/phone/Skype) meetings with clients in the state?

- Does a substantial chunk of my company’s revenue come from the state?

- Are any of my employees working in the state? Am I paying state payroll taxes there?

Federal registration

Unlike state and local governments, it’s not necessarily required for a business to register with the federal government to be considered a legal entity. However, there are some business statuses that do require federal registration. These include filing form 2553 with the IRS to create an S corporation or registering your business for tax-exempt status for nonprofit corporations.

While not required, businesses can also register with the federal government for trademark protection. This act can help prevent other businesses from using your trademarked terms – or to help you act in case anyone infringes on your business, brand, or product names. You can start this process by filing to trademark your business name or any other related terms with the U.S. Patent and Trademark Office.

Follow Tax Requirements

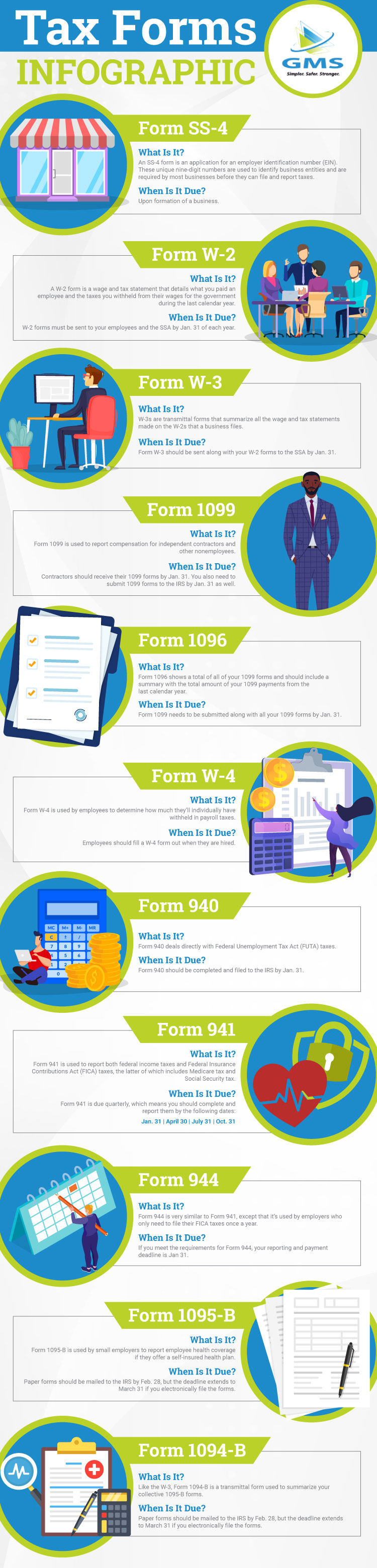

Once you’ve registered your business, it’s important to make sure your business is set up to meet federal and state tax requirements. While you may not need to federally register your business, it is necessary for most new businesses to file for an Employer Identification Number (EIN) with the IRS. This unique nine-digit number is essentially a federal tax ID that allows you to set up your business’ payroll and identify your business when you send required payroll documents to the IRS and state agencies. Some locations also require businesses to have employer ID numbers for state and local governments as well.

In addition, businesses will need to register for an Electronic Federal Tax Payment System (EFTPS) account. This account allows business owners to pay federal taxes online or over the phone. There are also many other steps involved with setting up and handling payroll. To learn more about what it takes to make sure your payroll process is in a good place, check out our detailed guide on how to manage payroll for a small business.

Obtain Any Necessary Business Permits and Licenses

Depending on what your business does, you may need to apply and pay for federal or state permits and licenses. According to the SBA, any business that deals with any of the following activities are regulated on the federal level and require special licenses or permits:

- Agriculture (U.S. Department of Agriculture)

- Alcohol (Alcohol and Tobacco Tax and Trade Bureau)

- Aviation (Federal Aviation Administration)

- Firearms, ammunition, and explosives (Bureau of Alcohol, Tobacco, Firearms and Explosives)

- Fish and wildlife (U.S. Fish and Wildlife Service)

- Commercial fishing (National Oceanic and Atmospheric Administration Fisheries Service)

- Maritime transportation (Federal Maritime Commission)

- Mining and drilling (Bureau of Safety and Environmental Enforcement)

- Nuclear energy (U.S. Nuclear Regulatory Commission)

- Radio and TV broadcasting (Federal Communications Commission)

- Transportation and logistics (U.S. Department of Transportation)

State licenses and permits are dependent on your location. Individual states tend to require permits and licenses for a broader spectrum of business activities than what’s federally required, which can mean you may need to obtain approval to operate in anything from construction to food service. In some cases, such as businesses that manufacture, import, or sell alcohol, you may need to acquire permits or licenses from both federal and state sources. Unfortunately, you’ll need to visit your state’s website to determine which permits and licenses are required and how to apply for any that pertain to your business.

Get Business Insurance

Business insurance isn’t only a way to protect your business, it’s also mandatory in some cases. Federal law requires that every business has workers’ compensation, unemployment, and disability insurance, while some states require additional insurance policies.

Another factor is that certain types of businesses may need to carry specific types of insurance. Whether it’s mandated by local laws or you just want to protect your business against potential risks, different types of insurance can include:

- Product liability insurance for manufacturers, wholesalers, distributors, and retailers

- Professional liability insurance for service-based businesses

- Commercial property insurance for businesses with property and/or physical assets

- Home-based business insurance for businesses run out of the owner’s personal home

- Business owner’s policy for small business owners looking for bundled coverage

Prepare Your Business with Professional HR Management

Opening a new business is a big investment, but it can succeed with the right team behind it. However, the administrative responsibilities of owning a business can dominate your schedule if you don’t have the right people to help you manage your business’ HR processes. That’s where a Professional Employer Organization like GMS can help.

Every company needs proper HR management, no matter how big or small it is or how long it’s been in business. GMS can partner with you to build a strong HR foundation for your business and give you access to payroll, benefits, and other HR experts who can manage your business’ administrative needs and keep you up to date with any new business laws and regulations. In turn, you can focus your time on whatever it takes to grow your business.

Ready to build toward a bright future for your business? Contact GMS today to talk to one of our experts about how we can support you and your company.