With the soaring costs of healthcare in the U.S., many citizens feel they are left with little to no alternatives when it comes to significant surgeries and procedures. This has helped propel many to look into the latest trend of “medical tourism” in an effort to get the operations they need without breaking the bank.

Citizens may be uneasy about the idea of receiving care outside of the United States, but there are some great facilities and specialists in other countries where the same level of treatment—or even better in some cases—can be received at a fraction of the price. That was the case for GMS employee Christine Mace when her husband Dan required hip surgery back in 2016.

Finding Affordable Treatment Through a Medical Concierge

Dan had been dealing with the pain for years and was willing to take any action necessary to resolve the issue.

He had seen several doctors in the states, who eventually advised he would be required to have hip surgery to fix the issue. During a consultation with a specialist from Akron, Dan inquired when the doctor thought he’d need surgery on his other hip. The doctor’s reply was “in a couple years.”

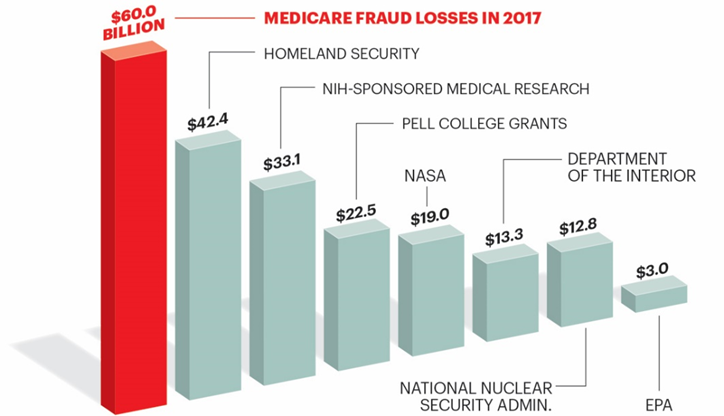

Chris Mace’s accounting background kicked in. She started researching the astronomical costs for a hip surgery in the U.S. and worried this would have a significant negative impact on the health insurance rates of her co-workers. She began researching alternatives to alleviate Dan’s pain. One day, Dan found an article in Parade Magazine about the idea of “medical tourism.”

Chris set up a meeting with GMS’ VP of Benefits, Beth Kohmann, to discuss other possibilities. The two contacted Akeso, a company who has a division specifically dedicated to assist in this process as a “Medical Concierge.”

Experts from Akeso discussed the problems Dan was having and began to do their research. They found that the Cayman Islands had a facility, Health City Hospitals, with some of best orthopedic and cardiac surgeons in the world.

Before he could even have his initial consult, Dan would first need to proceed with a full physical as well as a dental evaluation. This was a requirement of the Cayman facility so there would be no risk of bringing in a patient with existing infections that could detrimentally affect any other patients receiving treatment at their facility. The hospital boasts a 100 percent infection-free reputation. In that time, it was discovered that Dan had a Periodontal disease, and the pre-certification process helped assure the issue could be resolved without any severe affects to his dental health, an added bonus in the process.

Once they passed all the requirements, a meeting was set up with Dan, Chris, Beth Kohmann, and the potential surgeon from the Cayman hospital, Dr. Alwin Almeda.

Dan arrived shortly after their set time, and painfully walked to his seat at the table. The doctor focused on his gait and the clear pain shown on his face. By the time Dan was able to sit down, the doctor apologized and told Dan he would need to have him walk paces in front of the camera once again.

Between the evaluation of his gait, as well as the X-rays obtained here in the states, Dr. Almeda was able to identify the issue. He asked if Dan had ever been able to cross his legs or sit cross legged on the floor. Dan replied that he had never been able to do so, not even as a child. Dan was stunned because no one had ever asked him that before. Dr. Almeda identified the issue as Femoroacetabular Impingement (FAI). Dan then asked the doctor when he thought the other hip would need surgery, to which the doctor replied, “NEVER!” The impingement was only in the right hip, and the left hip showed no signs of needing repair. (Note – this doctor was using the same scans taken as the Akron doctor.)

When asked about his pain level on a standard 1-10 scale, Dan replied that his pain was at a 12. Dr. Almeda then informed Dan that he was a candidate because his level of pain matched what the doctor saw on the scan. The doctor then asked Dan why it had taken him so long to seek medical treatment to resolve his discomfort. Dan’s reply was “Fear and cost.” The doctor then replied that money should never be the reason someone is robbed of the finest quality of life they deserve. Dan knew this was the guy to resolve his issue. Dr. Almeda agreed that since Dan was cleared of all possible infections, he qualified as a patient at the facility.

Traveling Outside the U.S. for Medical Treatment

The Akeso rep listed off dates for Dan and Chris to travel to the Cayman Islands. They quickly set up plans to travel down a couple weeks later on Feb. 4 with the surgery on that following Saturday, Feb. 6.

Akeso set up first-class airfare for the trip down. Once Dan and Chris arrived, they had a rental car already set up. Chris quickly realized when they got to the rental that cars travel on the opposite side of the road, which led to a friendly police escort the rest of the way to the hospital.

Health City Cayman Islands was born from the vision of Dr. Devi Shetty, a renowned heart surgeon who was Mother Teresa’s personal physician, and supported by Narayana Health Group of Hospitals. This brain trust founded Health City Cayman Islands as part of an effort to bring low-cost, high-quality medicine and care to the Cayman Islands and nearby outposts in Central and South America.

According to the Maces, the hospital was comprised of staff mostly from India. At home, they would not have the same financial opportunity that Health City provided. On top of fair compensation, employees have their housing and food paid for, and the organization even pays for them to travel back to their home country for one month each year.

“You could tell how much they genuinely cared about their patients and improving their quality of life,” Chris said.

The Medical Tourism Experience

The staff walked them through the process and advised they would need to return for tests Friday and the surgery would be all set for Saturday. Dan was admitted into the hospital that Friday evening. The Maces were not prepared for what they saw when they entered his private hospital room. The room was approximately 30-by-30 feet with a beautiful garden view, huge private bathroom, living area, and desk. They explained that Dan would actually have his first therapy sessions right there in his room. Chris set up her office in the room and was able to work remotely while Dan was in surgery. All they had to do now was wait for the big day.

Their exemplary experience continued. The doctor paged Chris after the surgery was completed to tell her everything went as planned, and it was a success. After cutting into the hip, Dr. Almeda advised that the ball in the hip broke into three pieces because of the severity of the deterioration. It was also found, during testing, that Dan’s legs were not the same length. Dr. Almeda explained that since the surgery went so smoothly and he was already “in there,” he used bone putty to build up the pelvic bone, prior to installing the new prosthetic hip. The doctor felt that making both legs the same length would help Dan’s back, knee, and ankle pain. Dan was thrilled to find out he was an inch taller after the surgery! There was no additional cost for that part of the surgery.

Dr. Almeda accompanied Chris and Dan into recovery and stayed with them for three hours, discussing the entire process, viewing scans, and helping Dan stand that very same day. He helped alleviate any concerns they had moving forward.

Health City Cayman Islands kept Dan in the hospital until the following Thursday. After being discharged from the hospital, Chris and Dan went to the private residence to continue the recovery process. Chris went into the bedroom to do some organizing, leaving Dan watching TV. While in the bedroom, she suddenly heard Dan saying something directly behind her. She turned and realized he was up and walking without his walker. He was already so comfortable, that he didn’t even realize what he was doing.

They went back and forth to the hospital for PT for the remainder of their trip. Chris was treated to first-class dining at the hospital, which held a satellite kitchen from a four-star restaurant on the other side of the island.

When all was said and done, the whole experience came to a total of around $11,000 as compared to about $86,000 for just the hip surgery itself in the U.S. That cost included their first-class air fare to and from the island, a rental car, gas reimbursement, a $100-a-day food stipend, private residence on the beach, the hospital stay and surgery, and the PT that was required thereafter. A $3,600 refund towards deductible was also included in the deal.

Consider Alternative Health Options with the Medical Concierge Industry

The idea of undergoing a life-changing surgery is overwhelming on its own. Then there are the consultations, scheduling, financial concerns, health insurance review, recovery, physical therapy, and so on. It is clear why people like Chris and Dan Mace have become advocates of Akeso, Health City Cayman Islands, and the medical concierge industry as a whole.

Your employees are your most important asset. By partnering with a PEO like GMS, you can get insight into these types of programs through the experts of our Benefits Department to make sure your people get the care they need at the price they deserve. We can help lay out all your options to keep your group well informed and healthy, while helping save you time and money in other areas from Payroll to Human Resources and Risk Management. Contact GMS today to talk to our experts about how we can help your business.