Payroll forms can put a lot of pressure on business owners. When you’re in charge of a small business, it’s up to you to make sure that these forms are not only completed accurately, but on time as well. If you’re not careful, the penalties can range from $50 per faulty form all the way up to hundreds of thousands of dollars for notable violations.

One of the biggest struggles of managing payroll forms is simply knowing which forms apply to your business and what they do. We’ve compiled a list of payroll forms that you’ll likely need to know for your small business and how they work.

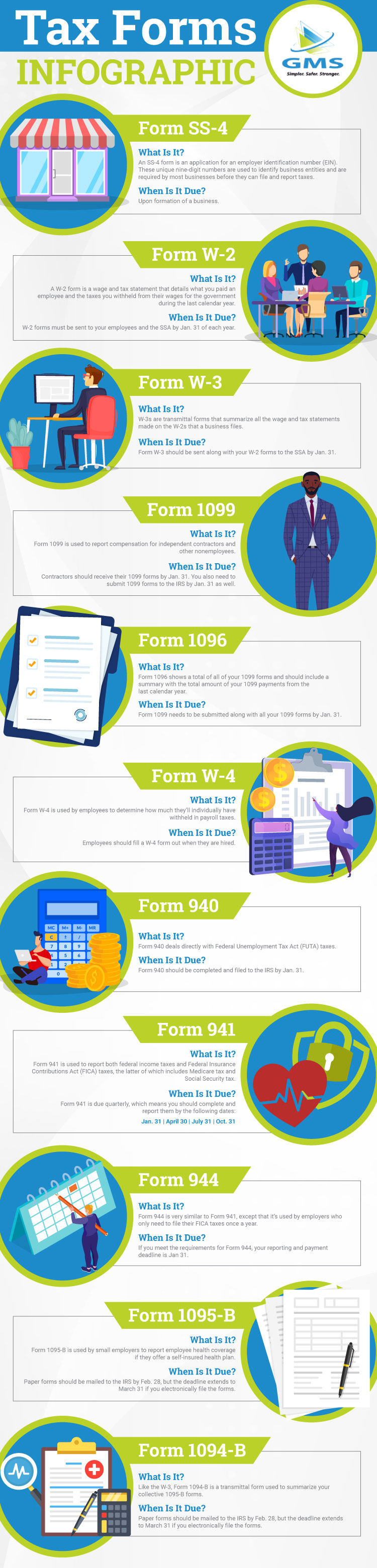

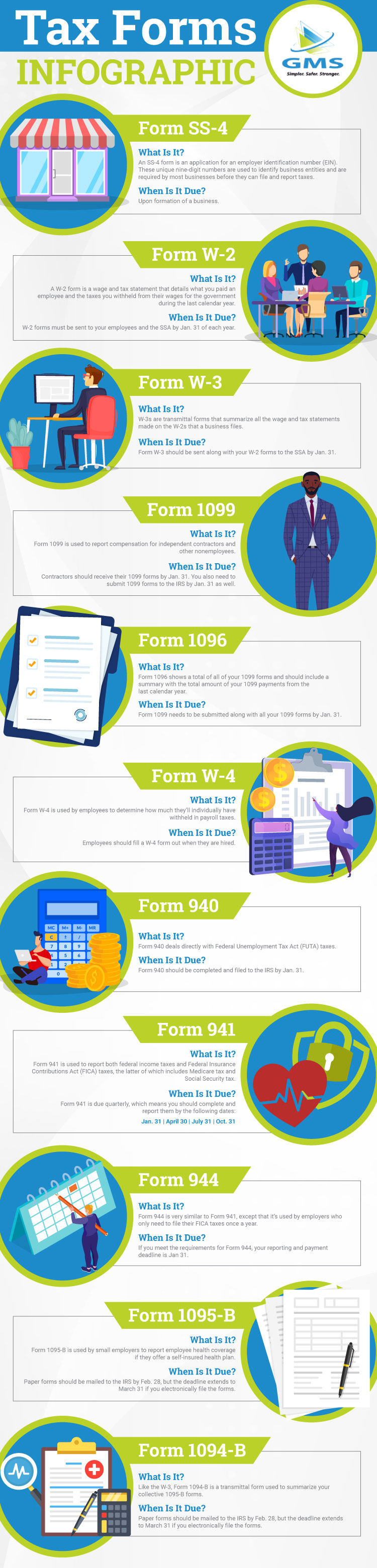

Form SS-4

What is it?

An SS-4 form is an application for an employer identification number (EIN). These unique nine-digit numbers are used to identify business entities and are required by most businesses before they can file and report taxes.

When is it due?

Unless you’re just about to start your business and haven’t paid anyone yet, you likely already have an EIN. There are some situations where you may need a new EIN, which the IRS has listed on its site. Aside from those scenarios, you won’t have to worry about refiling form SS-4 once you have your EIN.

Form W-2

What is it?

A W-2 form is a wage and tax statement that details what you paid an employee and the taxes you withheld from their wages for the government during the last calendar year. W-2s need to be completed for any employee who worked for you in the past year and copies should be sent to the Social Security Administration (SSA) and the employee listed on the W-2. In addition, you should hold onto a copy of each W-2 for at least years.

When is it due?

W-2 forms must be sent to your employees and the SSA by Jan. 31 of each year. Most state governments set the deadline at Jan. 31 as well, but make sure to check with your specific state tax agency in case your state’s date differs.

You can also request extensions to file forms with the SSA and distribute forms to your employees. For an SSA extension, you’ll need to fill out Form 8809 and submit it to the IRS between Jan. 1 and Jan. 31. The IRS will then either deny your request or grant you a single 30-day extension.

As for distribution to employees, you must mail a letter to the IRS to request an extension. The letter must explain why you need an extension, your name, business address, EIN, and signature. If approved, the IRS will grant you either a 15- or a 30-day extension.

Form W-3

What is it?

W-3 forms are closely related to W-2s. Essentially, W-3s are transmittal forms that summarize the all the wage and tax statements made on the W-2s that a business files. In short, if you fill out 10 W-2 forms for your 10 employees, Form W-3 should represent a total of all 10 W-2s.

When is it due?

Form W-3 should be sent along with your W-2 forms to the SSA by Jan. 31. However, you don’t need to send W-3s out to your employees.

Form 1099

What is it?

Form 1099 is used to report compensation for independent contractors and other nonemployees. If you pay a contractor more than $600 in a year, you need to report how much you paid them to both the contractor and the IRS so that these wages can be evaluated for tax purposes.

When is it due?

Contractors should receive their 1099 forms by Jan. 31. You also need to submit 1099 forms to the IRS by Jan. 31 as well.

Form 1096

What is it?

Remember how the SSA requires a Form W-3 to show a total of all your W-2 forms? Form 1096 has the same relationship with your 1099 forms and should include a summary with the total amount of your 1099 payments from the last calendar year.

When is it due?

Form 1099 needs to be submitted along with all your 1099 forms by Jan. 31.

Form W-4

What is it?

Form W-4 is used by employees to determine how much they’ll individually have withheld in payroll taxes. On this form, your employees will note how many withholding allowances apply to them. These allowances will allow you to determine the amount of payroll taxes each employee will have withheld from their paychecks.

When is it due?

Form W-4 doesn’t have an annual due date like other payroll forms. Instead, employees should fill a W-4 form out when they are hired. The IRS does recommend that employees submit a new W-4 form each year to account for any financial or personal changes, but it’s not mandatory. In this case, simply continue to withhold taxes based on an employee’s original Form W-4 until he or she provides a new one.

Form 940

What is it?

Form 940 deals directly with Federal Unemployment Tax Act (FUTA) taxes. Your business must pay FUTA taxes if you meet the following requirements:

- You paid at least $1,500 in wages in any calendar quarter during the past two years

- You had one or more employees for at least some part of a day in any 20 or more different weeks during the past two years

FUTA taxes are based on employee wages, but are only paid by the employer and not the employee, so make sure not to withhold FUTA taxes from employee wages. These taxes are paid quarterly and then reported once a year through Form 940.

When is it due?

Form 940 should be completed and filed to the IRS by Jan. 31. However, the IRS will extend the filing due date to Feb. 10 if you pay all your FUTA taxes on time.

Form 941

What is it?

Form 941 is used to report both federal income taxes and Federal Insurance Contributions Act (FICA) taxes, the latter of which includes Medicare tax and Social Security tax. If your business’ quarterly tax liability is between less than $2,500, you can also use Form 941 to make tax deposits as well. If your liability is more than $2,500, the IRS requires that you follow a deposit schedule.

When is it due?

Form 941 is due quarterly, which means you should complete and report them by the following dates:

- Jan. 31

- April 30

- July 31

- Oct. 31

Form 944

What is it?

Form 944 is very similar to Form 941, except that it’s used by employers who only need to file their FICA taxes once a year. The IRS grants an exemption for small employers whose annual liability for social security, Medicare, and withheld federal income taxes is $1,000 or less for the year. If your business falls within those limits, you get to file Form 944 instead of Form 941.

When is it due?

If you meet the requirements for Form 944, your reporting and payment deadline is Jan 31.

Form 1095-B

What is it?

Form 1095-B is used by small employers to report employee health coverage if they offer a self-insured health plan. With a self-insured plan, employers pay medical bills instead of just a premium, so the IRS requires Form 1095-B to verify that individuals on your plan had minimum essential coverage. If you offer a fully-insured plan, your health insurance provider will fill out and file Form 1095-A for you.

When is it due?

A copy of Form 1095-B should be filed for each full-time employee covered by your plan. Individual forms should be mailed to corresponding employees by Jan. 31. The filing deadline for the IRS differs depending on how you send Form 1095-B to them. Paper forms should be mailed to the IRS by Feb. 28, but the deadline extends to March 31 if you electronically file the forms. It’s also important to keep a copy of each employee’s forms.

Form 1094-B

What is it?

Like the W-3, Form 1094-B is a transmittal form used to summarize your collective 1095-B forms. This form is very simple and only requires some basic company information and a total for the number of 1095-B forms you will submit along with Form 1094-B.

When is it due?

The deadlines for 1094-B are the same as Form 1095-B. The only difference is that employees do not receive 1094-B.

Place an Emphasis on Proper Payroll Management

Payroll forms can be tricky, but they’re just one part of the payroll puzzle. Payroll administration is comprised of many different steps and responsibilities that can have major impacts on your business. To see just how much can go into the payroll process, check out our guide on what it takes to manage payroll for a small business.

Even when you have a good understanding of each payroll form, the time and effort it takes to complete them and manage your payroll can put a serious dent in your schedule. That’s why many owners turn to GMS to handle payroll administration for their small business. Our experts take an active approach to managing your payroll so that you can spend your time growing your business instead of struggling with forms and tax calculations.

Want to find out how GMS can save you time and money while strengthening your business’ HR functions? Contact GMS today to talk to one of our experts about your business.