As a business owner, you’re going to have to deal with a seemingly endless number of payroll obligations. Managing payroll for a small business isn’t easy, especially when it comes to dealing with payroll taxes.

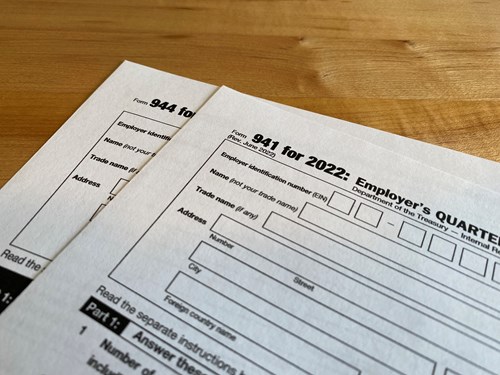

Between calculating payroll taxes and filling out numerous forms, business owners spend nearly five hours each pay period managing the payroll tax process. That’s a lot of time, especially when it’s not always clear whether an employer should use Form 941 or 944 to report their payroll taxes. Keep reading to learn the difference between these forms and which is right for your business.

What Is Form 944?

Form 944 is a method that certain employers use to report payroll tax information to the IRS. Employers can fill out a 944 form to inform the IRS about their payroll tax responsibilities. These responsibilities include reporting their employees’ wages and the amount of payroll taxes withheld from their paychecks, including:

- Federal income tax

- FICA taxes (Social Security and Medicare taxes)

- State and local income taxes (if applicable)

Note: While federal unemployment (FUTA) tax is also considered a payroll tax, employers should use Form 940 to report their federal unemployment tax contributions.

Only certain employers are allowed to use 944 forms for wage and tax reporting. According to the IRS, Form 944 should only be used if you expect that your payroll tax liability will be $1,000 or less for the whole tax year.

New employers can request to file 944 tax forms when they apply for an employer identification number (EIN). If a business has previously filed 941 forms, they can submit a request to the IRS to file Form 944 instead. For more info, check out IRS.gov for instructions on how to request a 944 form.

What Is Form 941?

Form 941 is very similar to Form 944, except that it’s meant for businesses with annual payroll tax liabilities greater than $1,000. Businesses should generally file Form 941 unless the IRS tells you to use Form 944 or if you successfully request to use 944 forms because of your lower liability.

What Information Do You Need To File Forms 941 And 944?

Although the total tax thresholds are different, both 944 and 941 tax forms require businesses to provide the same types of information. Any business filing these tax forms must report the following information to the IRS.

- Employer information (e.g., EIN, name, and address)

- Total number of employees that were paid

- Employee compensation (wages, tips, and anything else paid to employees)

- The amount of federal income tax, Social Security tax, and Medicare tax paid by the business and withheld from employees

- Total amount of tax liability

- Paid sick or family leave wages, if applicable

- COBRA information, if applicable

- Any necessary adjustments

When To File 941 And 944 Tax Forms

Another key difference between Form 944 and 941 is when you have to submit them. Form 944 is submitted on an annual basis and should report wage and tax information accounting for all four quarters. Any business filling out Form 944 must submit it by Jan. 31, or the following business day if Jan. 31 falls on a weekend or holiday.

Employers with more than $1,000 in tax liability must file quarterly. Each 941 form should account for a different quarter’s wage and tax information and submitted by the following dates:

- Q1 – April 30

- Q2 – July 31

- Q3 – Oct. 31

- Q4 – Jan. 31

As with Form 944, the due dates for Form 941 fall on the next business day if a quarter ends on a weekend or holiday.

How To File Forms 941 And 944

The IRS gives businesses two ways to file Forms 941 and 944:

- By mail

- E-filing

There are different mailing addresses for businesses depending on their location, special exemptions, and whether the business is deciding to file and pay their payroll taxes at the same time. Fortunately, the IRS lists out every possible scenario on their website:

Businesses that want to e-file payroll tax forms can also choose to do so online. This process is not only quicker, but also more secure. Employers can choose to e-file Forms 941 or 944 on their own or have a tax professional submit these forms on their behalf. The IRS provides guidelines for how to e-file Forms 941 and 944 on their website.

How To Submit Tax Payments For Form 941 And 944

The IRS requires business to deposit payroll taxes via electronic funds transfer. These payments should be made throughout the year, but the depositing schedule can vary based on which form a business files and overall tax liability.

Form 941

- $50,000 or less – Monthly deposits with a due date on the 15th of the following month.

- More than $50,000 – Semiweekly deposits with due dates based on payday.

- The following Wednesday if payday falls on Wednesday, Thursday, or Friday.

- The following Friday if payday falls on Saturday, Sunday, Monday, or Tuesday.

Form 944

- Less than $2,500 in a year – Pay when you file Form 944, Employer's Annual Federal Tax Return

- More than $2,500 annually, but less than $2,500 for the quarter – Pay by the last day of the month following the end of the quarter.

- $2,500 or more for the quarter – Make deposits following the monthly or semiweekly timelines to avoid failure-to-deposit penalties.

Regardless of deposit schedule, the IRS recommends that businesses use the Electronic Federal Tax Payment System (EFTPS) to make payments. Businesses can also have a payroll service or other third-party service make payroll tax deposits on their behalf.

How To Correct Any Mistakes On Form 941 Or 944

At some point, there’s a good chance that an employer will make a mistake filling out payroll tax forms. The IRS allows businesses to file Form 941-X and Form 944-X to correct any errors for past forms. If there are reporting errors for multiple forms, employers will need to file a separate 941-X or 944-X form to account for each original form.

The deadlines for corrections depend on the error. Businesses that accidentally underreport payroll taxes should submit a correction by the same quarterly due dates:

- Q1 – April 30

- Q2 – July 31

- Q3 – Oct. 31

- Q4 – Jan. 31

If a business overreports its taxes, the employer must file a corrective form within whichever of the due dates is later:

- Three years from the original filing date for the 941 or 944 form

- Two years after the business paid the overreported tax

Businesses that overreport can also apply the overreported amount as a future credit. This process can be done at least 90 days before the two or three-year due date expires.

Streamline Your Payroll Process

Managing payroll taxes is no simple process. Between the time it takes to stay compliant and the odds of paying tax fines for honest mistakes, it’s time to find a partner that can save you both time and money.

GMS works with businesses to take control of your payroll and your schedule. We seamlessly blend proprietary technology with dedicated HR support so that your business stays on top of managing payroll and tax filings.

Ready to stop worrying about tax calculations and start spending time growing your business? Contact GMS today to learn how we can streamline your business through payroll administration services.