Payroll management is no simple task. Regardless of whether your workforce is 50 strong or you can count the number of employees on two hands, there are lots of employees and documents to keep track of and failure to do so could result in serious penalties and fines. To help, we’ve put together a guide for better managing payroll records.

What Payroll Records to Keep and For How Long

Payroll records are documents and items related to paying your employees. Similar to how a candidate’s job applications and interview records need to be kept for one year, the U.S. Department of Labor (DOL) Wage and Hour Division and Internal Revenue Service (IRS) require employers to keep payroll documents for a set amount of time. Here are the payroll records you need to keep in your files:

Hiring documents

Hiring documentation like an offer letter include DOL-required employee data, such as their residential address, job title, and pay rate.

Keep for three years.

I-9 documents

These include information about an employee’s eligibility to work in the U.S. and DOL-required information like the employee’s full name and Social Security number.

Keep for three years.

Time cards

Time cards show total hours worked, including unpaid lunch breaks and overtime pay.

Keep for three years.

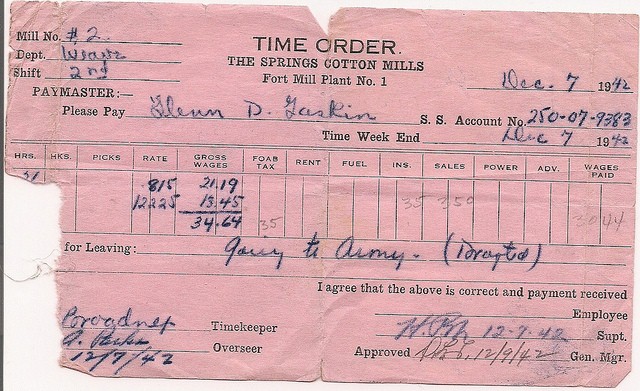

Paystubs

These will show payment dates and the total wages each period. Paystubs will also include any additions (like reimbursement) or deductions (like taxes and benefits) to wages.

Keep for four years.

Employee handbook

Every employee should have signed your employee handbook. Employee handbooks provide information on how your employees are paid (hourly or salary) and how often you pay employees (weekly, biweekly, monthly). It also describes information regarding paid holidays, termination, and severance.

Keep for three years.

Compensation philosophy

A compensation philosophy shows how you determine employee pay grades. You’ll also need to show rationale for pay increases or merit increases, as required by the Equal Employment Opportunity Commission (EEOC).

Keep for two years.

Tax forms

The IRS requires employee and employer tax documents, including W-4s (employees’ withholding allowance certificates) and W-2s or W-3s (employee’s wage and tax statements).

You’ll also need to keep payroll tax payments, which can be found on Forms 941 (employer’s quarterly tax form, which also includes information on tipped wages) and 940 (employer’s annual federal unemployment tax return).

Keep for four years.

Retirement income

Retirement income statements show 401k or profit-sharing plan details as required by the Employee Retirement Income Security Act (ERISA). You’ll also need to keep documents outlining enrollment, payment, and payroll deduction.

Keep for six years.

Leave documentation

The Family Medical Leave Act (FMLA) requires payroll records regarding your leave policy, requests for leave, leave balances, and leave payments. This information is typically found in your employee handbook or on employee paystubs.

Keep for three years.

Termination information

A termination letter outlines an employee’s end date and any final payments, such as unused paid time off or severance.

Keep for three years.

Keep in mind that anytime you have a dispute relating to payment or employment with an employee, it’s best practice to keep all payroll records until the dispute has been resolved.

State-Specific Payroll Records Retention

Most states abide by the payroll records retention guidelines provided by the U.S. Department of Labor and IRS, as detailed above. However, a few states have further legislation that affects what payroll records to keep and for how long. These include the following exceptions:

- New York requires payroll records to be kept for six years.

- California requires that all payroll records be retained for six years.

- Illinois requires employers to keep all payroll records for five years.

- Washington has more specific requirements of what payroll records to retain.

Destroying Payroll Records

Keep in mind that holding onto payroll records for longer than required can put business owners at risk. Financial and personal information related to payroll, such as bank account information, credit reports, and photocopies of social security cards, should be destroyed after the retention time frame to prevent confidential data from being misused. In case any questions about destroyed documents arise, you’ll also want to keep track of which payroll records you’ve destroyed and when.

How to Store Payroll Records

As you can see, there are lots of payroll records to manage. Business owners will need a good filing system to keep track of these documents.

Think twice before storing paper records in filing cabinets or boxes. Often, these records are forgotten about and kept for longer than needed. It’s also time-consuming to manually file each document and can be even more tiresome should you need to refer back to certain records. Security can also be an issue, as these filing systems are often easily accessible.

Rather, savvy business owners have found that it’s much more efficient to digitally store these important documents in a payroll management system. This ensures that records are securely stored and can be readily available from anywhere there’s an internet connection. Additional online payroll software benefits include:

- Payroll processing. Ensure employees are paid on time every pay period and electronically store information regarding paystubs, payroll deductions and time tracking.

- Payroll tax. Streamline filing and ongoing maintenance of tax records.

- Employee self-service. Give employees 24/7 access to their payroll and tax information.

Outsource Payroll Records Management

When it comes to payroll records, there’s a lot of information to process—mentally and literally. Outsourcing payroll records management through a professional employer organization (PEO) like Group Management Services can help business owners save time and worry. We take on the burden of payroll records management, so you can put your focus back on client relationships, building and effective team, and growing your profits. In addition, GMS provides human resources, risk management, employee benefits services to help make your business simpler, safer, and stronger.

Stop wasting time on payroll records management. Contact us today to talk to one of our experts about our payroll services.